|

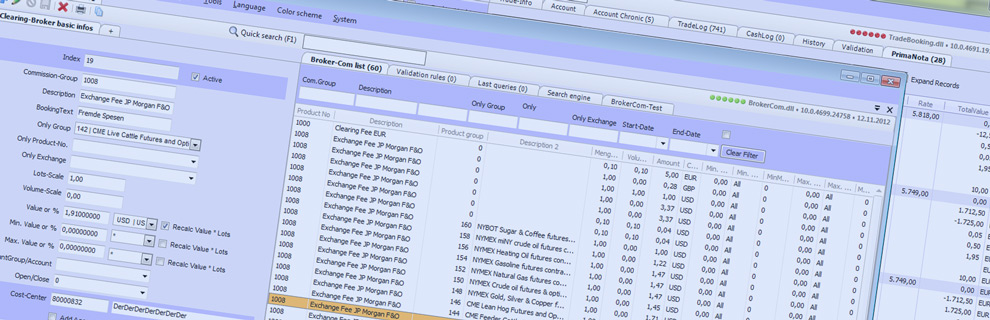

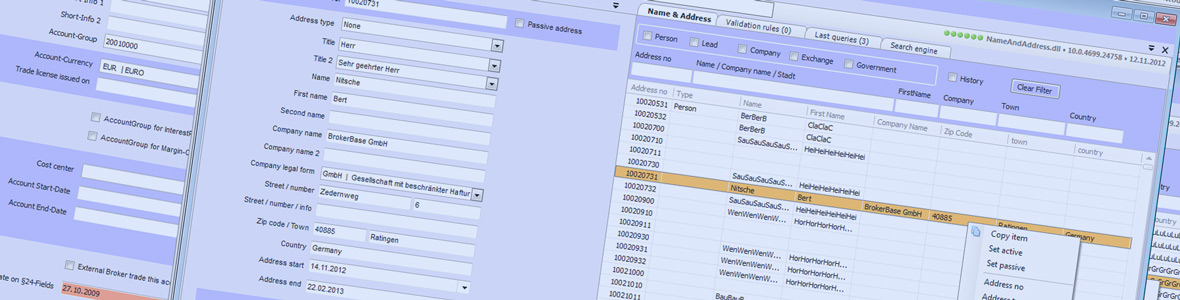

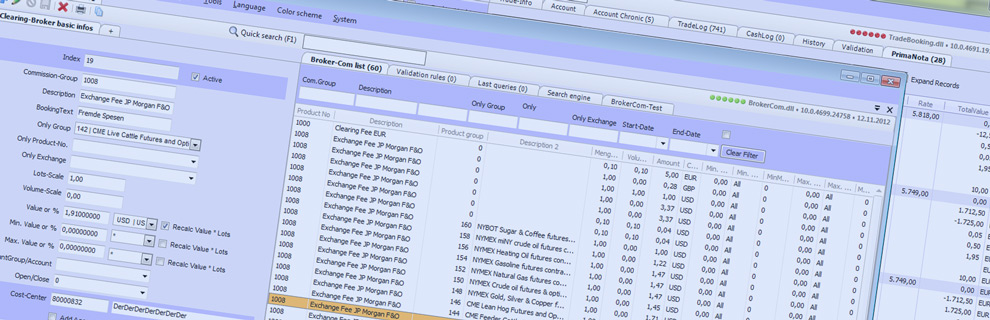

Broker Base offers multiple masks for the lending business that supports the user with the best in their daily business. There are all the usual features

such as interest rates, interest scales in different currencies, Delta method with interest (eg EURIBOR + 0.25%, in which case only the EURIBOR needs to

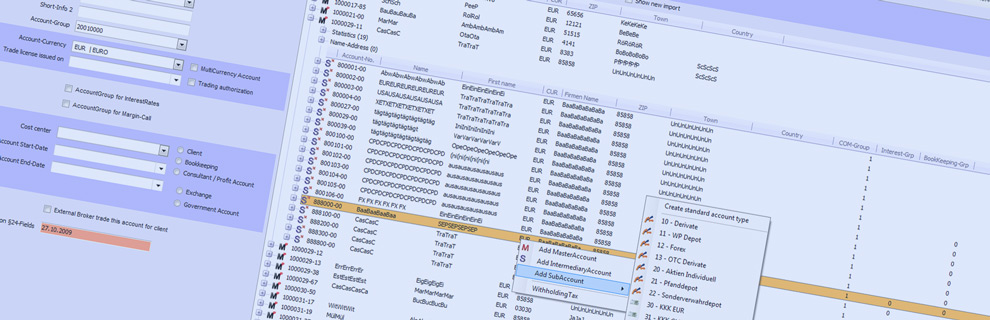

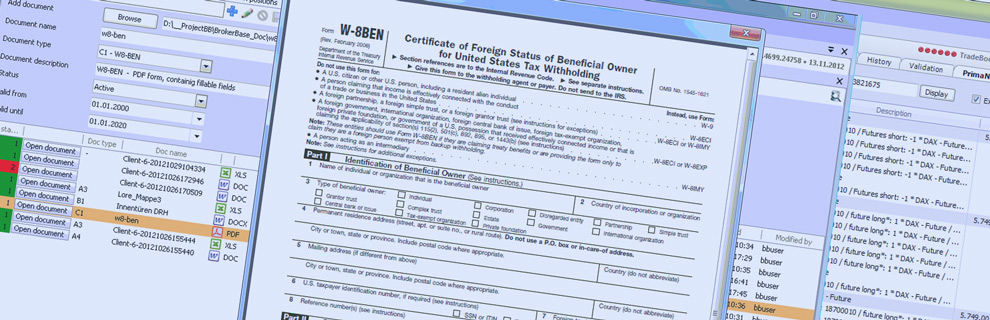

be maintained), offered maturities, fees, commissions, etc.. It also supports mapping complex structures, considering that all the accounts are basically

multi-currency accounts in BrokerBase.

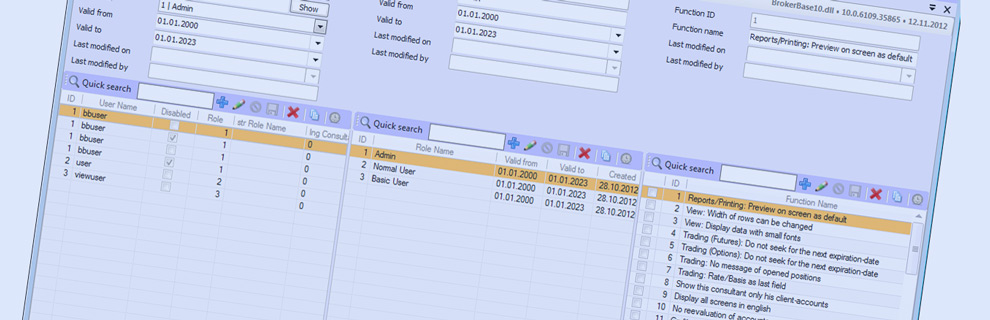

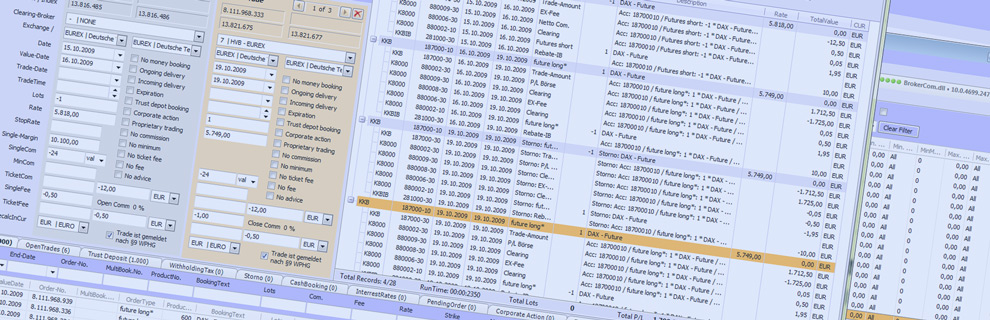

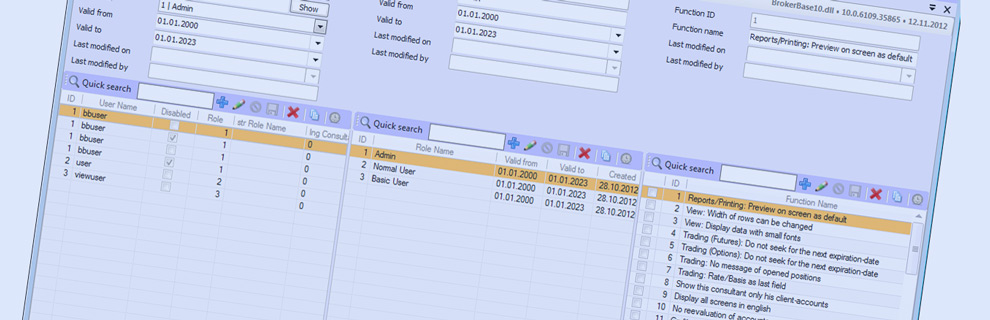

The BBECS (Broker Base Event Control System) is an electronic workflow that monitors the entire credit system, automatically creates the credit bookings,

accepts payments due and controls the further processes. When limits are exceeded or upon expiry of overdraft, the BBECS automatically informs the users,

based on the user role about the events, so that following the four-eyes principle, further steps can be taken.

The following products are suplied for the BrokerBase lending masks:

- Overdraft

- Credit contractions

- Loans with issuer risk and foreign exchange transactions

- List&Label Reports for the representation of loans

Starting with version 10.0, all credit related masks that are included in BrokerBase have a central electronically controlled workflow (BBECS) and role based controled access.

|