|

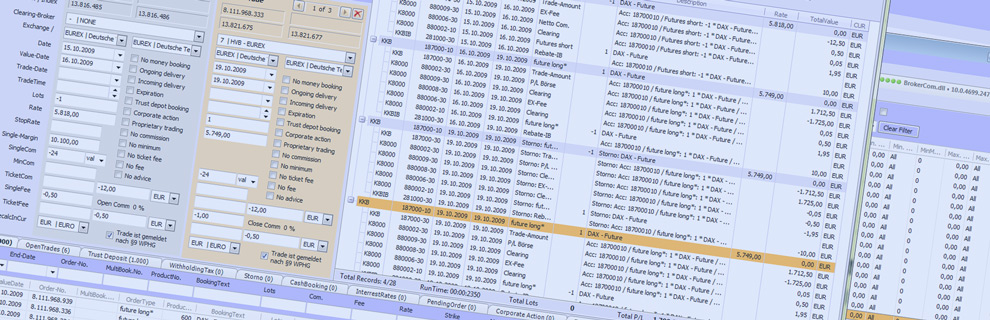

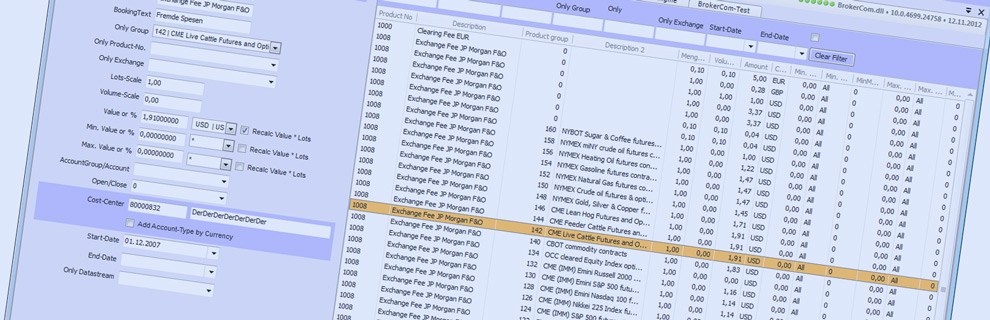

BrokerBase provides several masks for national and international payments. All bookings are recognized and booked by the BrokerBase BookingMachine.

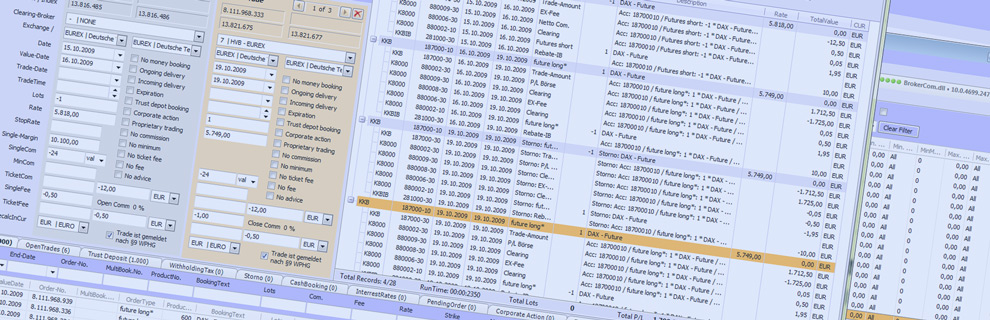

The BookingMachine has a transaction history, that can be viewed and browsed easily with the help of the filtering system. Additionally, the accounting

accounts and subledger accounts are displayed on each payment.

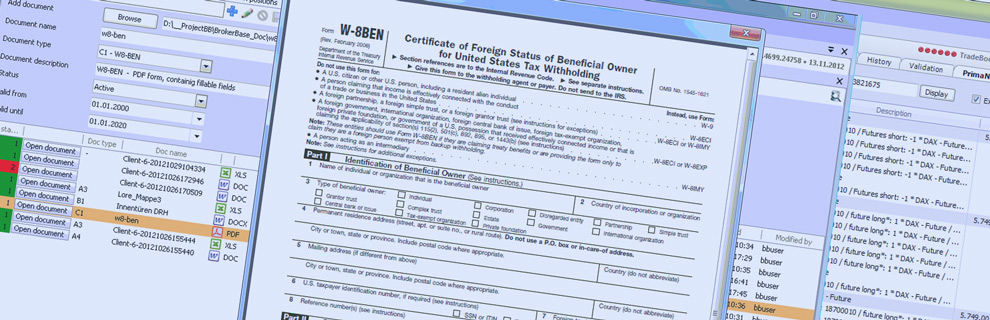

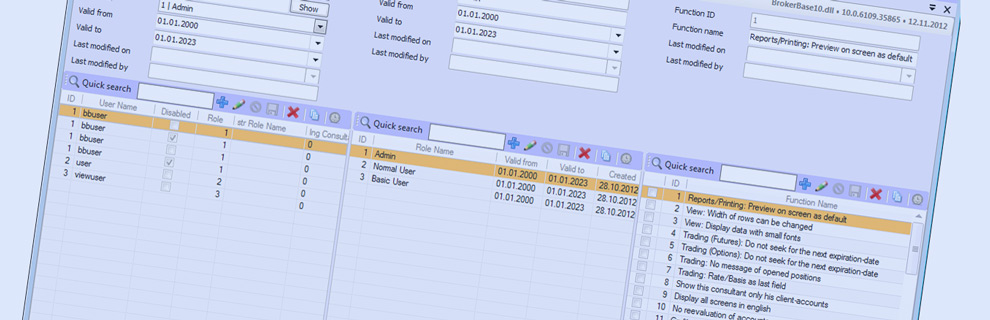

The BBECS (BrokerBase Event Control System) is an electronic workflow that helps the user to perform additional steps in their bookings. For example, it is

possible that for just booked stocks, corporate action to be incurred. BBECS will find these cases and will display them to the user as an event.

The BrokerBase Cashbooking mask provides the possibility to trade the following products:

- Forward rate agreements (FRA)

- InterestRateSwap (IRS)

- FX spot / forward

- Energy

- Cash depot

- Repos

- Future

All cashbookings are automatically parsed, read and took over by the BookingMachine, following these three steps:

1. Read in

2. Checking for data completeness - data maintenance if needed

3. Booking on the accounts (using main booking / sub-booking system)

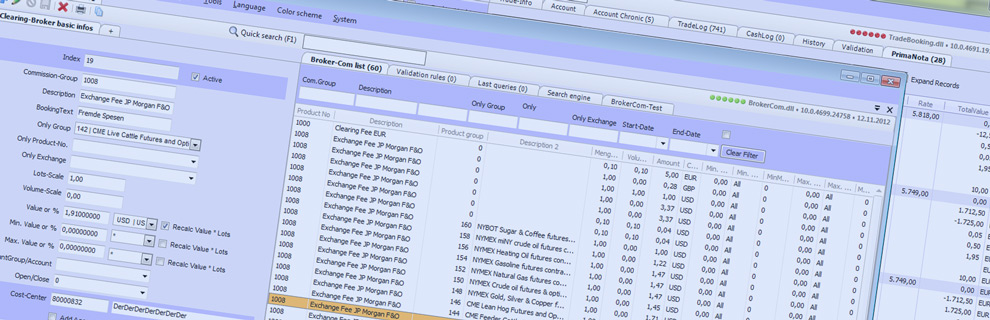

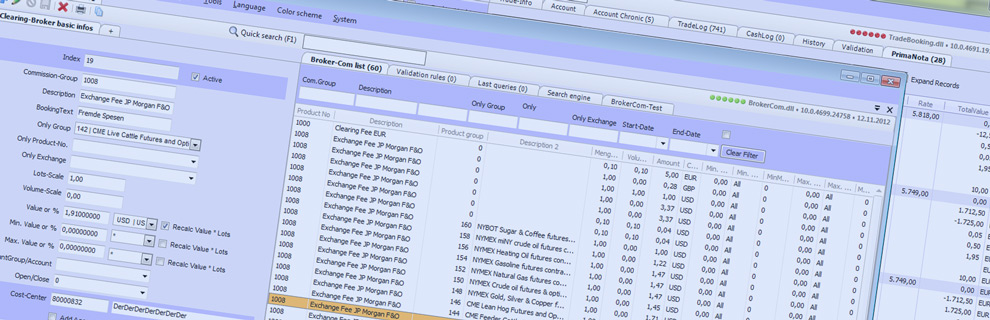

Through the interfaces, all cash transactions are routed (for example commission payments for sales). Starting with version 10.0, all the payments masks

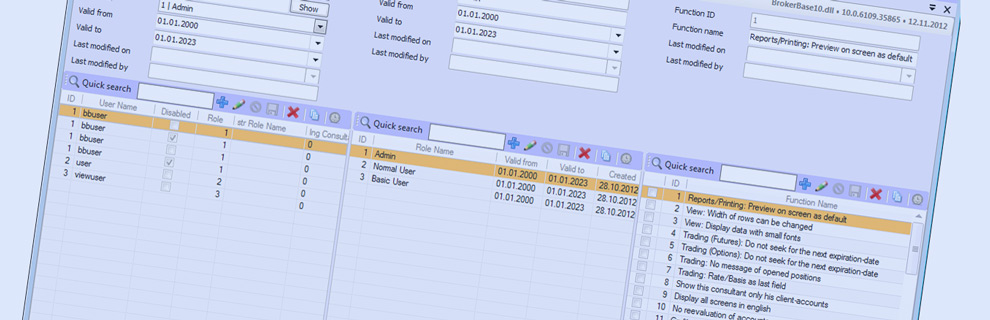

that are included in BrokerBase have a central electronically controlled workflow (BBECS) and role based controled access.

|