| |

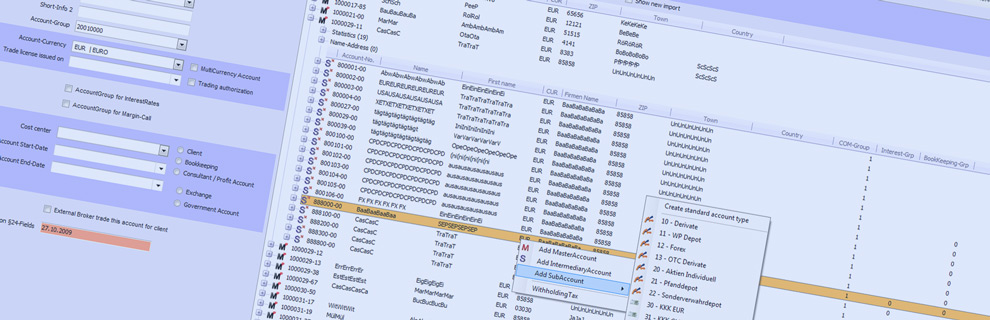

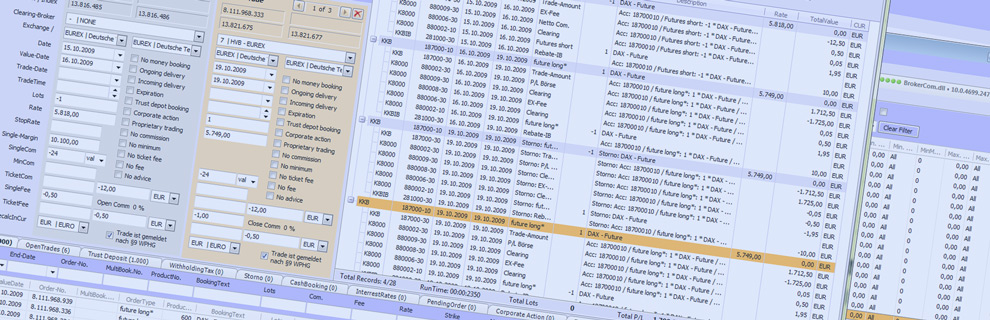

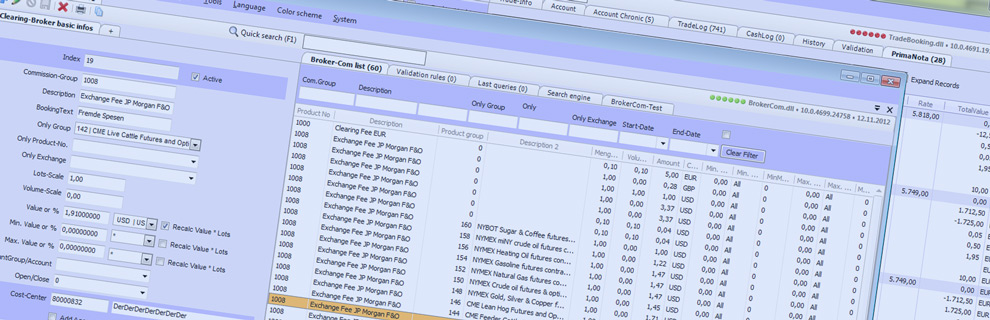

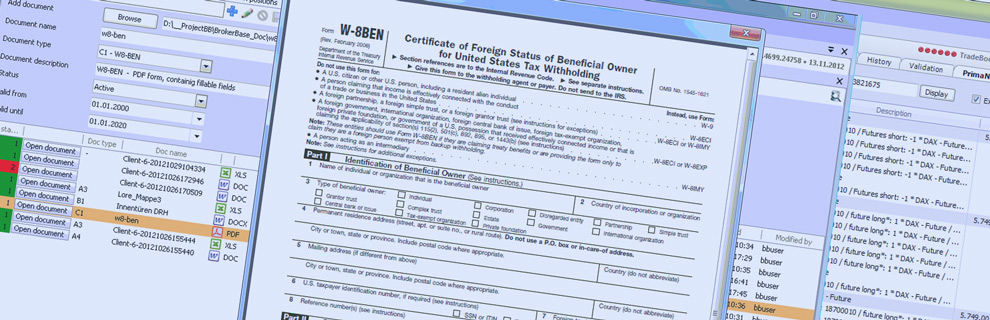

|  • Event-Controlling • Elektronischer Workflow • volle Kontrolle  Technologiesprung zwischen BrokerBase 9.00 und BrokerBase 10.00 für Banking-Core-Systeme |

| |

|  • Event-Controlling • Elektronischer Workflow • volle Kontrolle  Technologiesprung zwischen BrokerBase 9.00 und BrokerBase 10.00 für Banking-Core-Systeme |